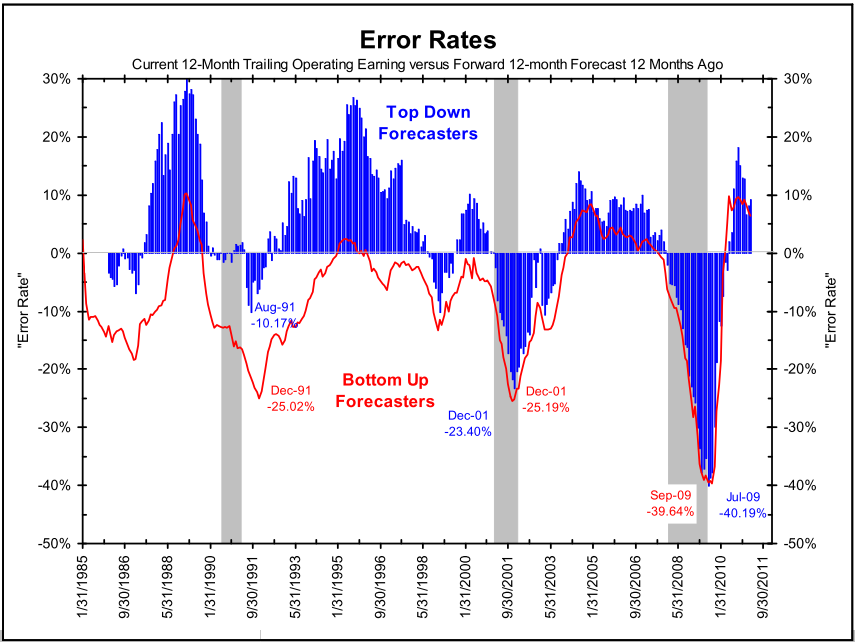

Source: Bianco Research (shaded areas = recessions)

>

Here is a question worth considering: Is Wall Street setting itself up for another huge Earnings miss?Consider the chart above, and the differences between Wall Street forecasts and actual quarterly earnings from 1985-2011.

Jim Bianco notes that “Wall Street is one of the few places where practice does not make perfect. Notice that every subsequent recession sees larger earnings error rates than the previous recession.”

Consider the prior significant earnings misses:

• 1990/1991 Recession: Top-down forecasters (strategists) were too optimistic by 10%. Bottoms–up forecasters (adding up the 500 company forecasts) were too optimistic by 25%.

• 2000/2001 Recession: Top-down forecasters were too optimistic by 25%. Bottom-up forecasters were too optimistic by 23%.

• 2007/2009 “Great Recession” top-down forecasters were too optimistic by 39.6%. Bottom-up forecasters were too optimistic by 40%.

Both strategists and Analysts seem to be getting significantly worse at predicting earnings.

The significance of this is what might happen if the economy slips into recession: In the event that occurs, present earnings forecasts for 2012 of $112 might too high by as much as 20% to 40%.

Hence, why a recession driven earnings contraction supports much lower equity prices.

Are markets cheap? The correct answer is it depends on the economy and earnings over the next few quarters . . .

Source: The Big Picture, September 7, 2011.