From afraidtotrade.com:

What signals or clues are coming from the broader Sector Rotation Model as we see it in July 2011?

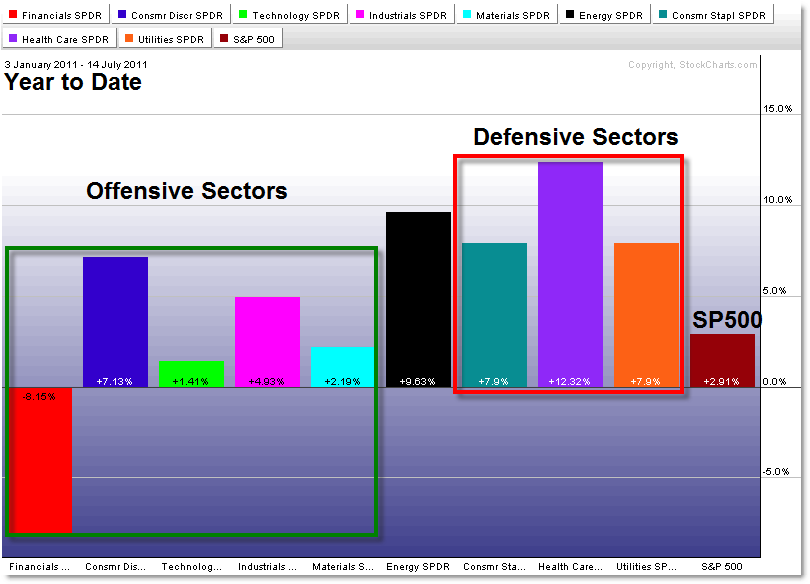

Let’s take a look, starting with the data Year to Date:

Consistent from our prior update in May 2011, the Sector Rotation Model continues to show Defensive/Protective money flows, which casts a cautious tone over the broader state of the stock market.

Relative Strength appearing in the three defensive sectors of Staples, Health Care, and Utilities generally suggests that money managers/investors are defensively positioning their assets to protect against further downside in the stock market.

If they were optimistic and hopeful of future economic or stock market strength, they would overweight in the Offensive Sectors of Financials, Discretionary, Technology, Industrials, or Materials.

With 2011 halfway complete, the Sector Rotation Model shows defensive or protective posturing.

All Defensive Sectors have increased at least twice as much (percentage wise) as the S&P 500 (up 3% so far). Health Care rallied over 12%.

The other two standouts are Energy (in its own category) up 9.5% and Consumer Staples – the only bullish sign – up 7% so far.

While the larger Rotation Picture is bearish/defensive, let’s look at a shorter-term model from a key reference point.

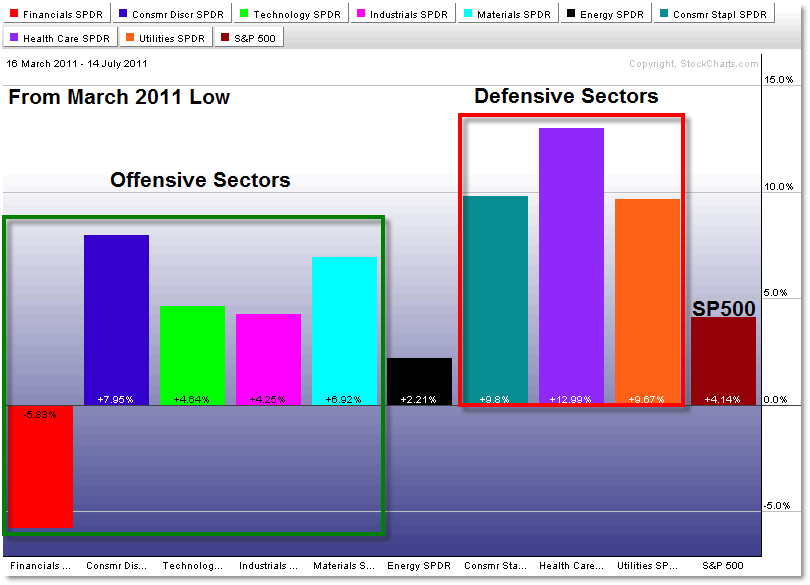

Here is the same chart starting with the March 16, 2011 Stock Market Low:

Perhaps not surprisingly, the model shows very similar data.

Strength still resides in the Defensive/Protective Sectors, though we see a slightly more positive growth recently in the Offensive Sectors.

The big stand-out in both charts is the Financials (XLF) sector – down 8% year to date and down 6% from the March 2011 low.

That’s not something you want to see if you’re expecting bullish/positive movement in the stock market.

Anyway, continue to study the current Model (using sector ETFs) for additional insights and potential trading opportunities from the strongest stocks in the strongest sectors, or weakest stocks in the weakest sectors.

Corey Rosenbloom, CMT